Imagine finding your dream home, the perfect place to start a new chapter of your life. But what happens if unforeseen circumstances make it impossible for you to make your mortgage payments? This is where the dreaded term “foreclosure” comes into play. In a nutshell, foreclosure is when a lender takes legal action to repossess your property because you have failed to meet your payment obligations. It’s a situation no one wants to find themselves in, but understanding what foreclosure means and how it can potentially impact you is crucial in order to navigate this complex process.

What is a foreclosure?

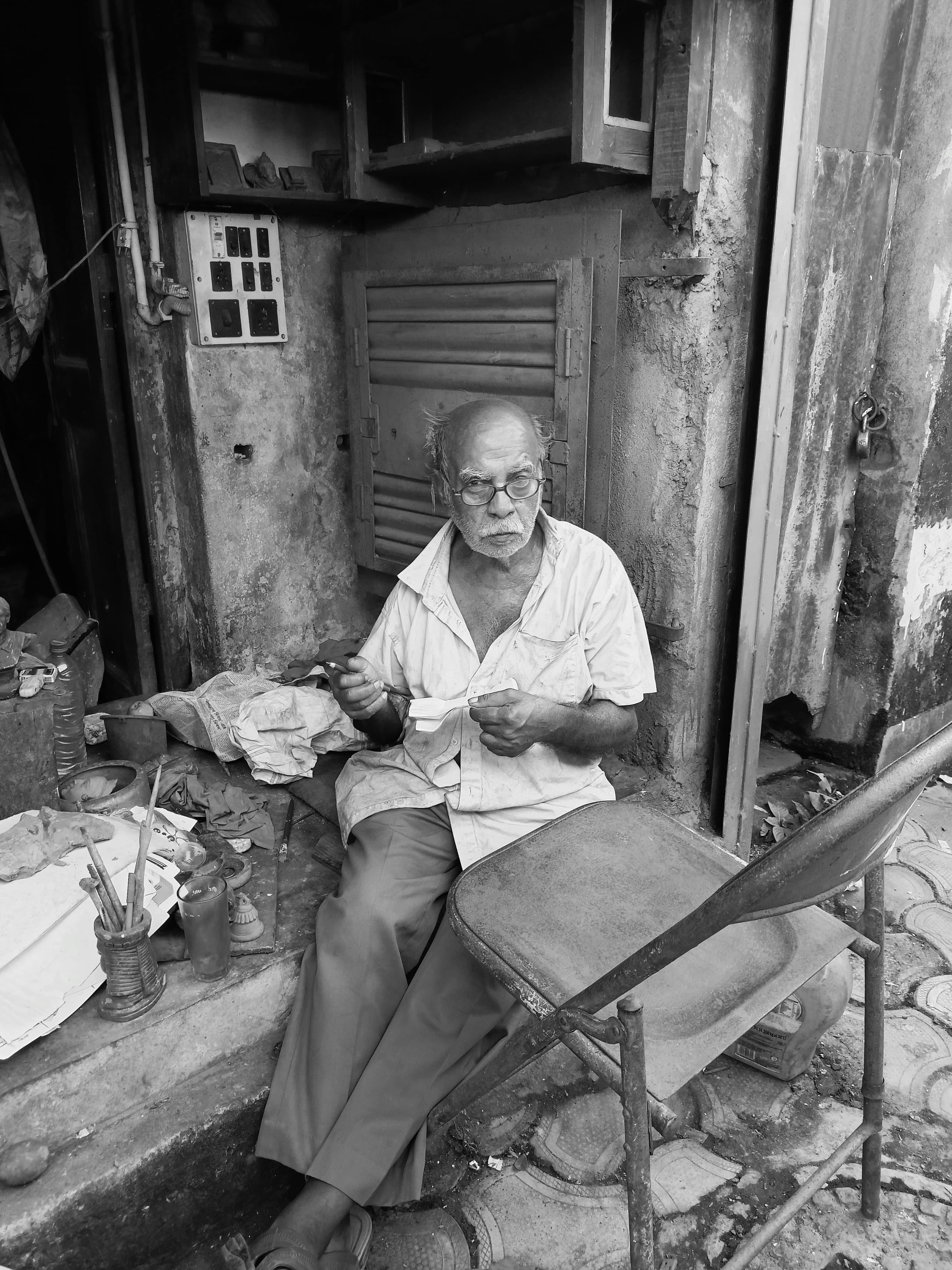

This image is property of images.pexels.com.

Definition of a foreclosure

A foreclosure is a legal process through which a lender takes possession of a property when a homeowner fails to make timely mortgage payments. It is a drastic measure that is usually taken as a last resort when all other efforts to resolve the borrower’s delinquency have been exhausted. When a foreclosure occurs, the lender has the right to sell the property to recover the outstanding balance on the mortgage loan.

How does foreclosure work?

Foreclosure typically begins when a homeowner falls behind on their mortgage payments, usually for several months. The exact process can vary depending on the jurisdiction, but it usually involves the lender filing a lawsuit against the homeowner to initiate the foreclosure process. The homeowner is then served with a notice of default and given a certain period of time to respond and either pay the outstanding amount or come to an agreement with the lender.

If the homeowner fails to take corrective action, the lender can obtain a court order to foreclose on the property. The property is then typically auctioned off, and the highest bidder becomes the new owner. In some cases, if the property fails to sell at auction, it may become real estate owned (REO), meaning the lender becomes the owner and can sell it through traditional channels.

Types of foreclosure

There are several different types of foreclosure, including judicial foreclosure, non-judicial foreclosure, and strict foreclosure.

-

Judicial foreclosure: This is the most common type of foreclosure and it involves the lender filing a lawsuit in court to obtain a judgment allowing them to sell the property. The court oversees the entire process, including the auction.

-

Non-judicial foreclosure: In some states, foreclosures can be conducted without court involvement. Instead, the lender follows a specific process outlined in the mortgage or deed of trust documents. Non-judicial foreclosure is typically faster than judicial foreclosure.

-

Strict foreclosure: This type of foreclosure is less common and is used in a few states. In a strict foreclosure, the lender takes ownership of the property without going through a public auction. The homeowner has a limited period of time to redeem the property by paying off the outstanding debt.

Foreclosure process

The foreclosure process can vary depending on the jurisdiction, but it generally follows a similar sequence of steps. These steps typically include:

-

Pre-foreclosure: This is the initial stage when the homeowner first falls behind on their mortgage payments. During this stage, the lender will typically send notices, make phone calls, or attempt to work out a solution with the homeowner to bring the mortgage current.

-

Notice of default: If the homeowner fails to rectify the delinquency, the lender will send a notice of default, which formally starts the foreclosure process. This notice provides the homeowner with a specific period of time to bring the mortgage payments up to date.

-

Foreclosure auction: If the homeowner does not resolve the delinquency within the specified time frame, the lender will schedule an auction to sell the property to the highest bidder. The auction is usually conducted by a public trustee or sheriff’s office.

-

Post-foreclosure: If the property sells at auction, the new owner takes possession. If the property does not sell, it becomes real estate owned (REO) by the lender. The lender can then sell it through real estate agents or other means.

This image is property of images.pexels.com.

Reasons for foreclosure

Foreclosures can occur for various reasons, but some common causes include:

-

Financial hardship: Job loss, income reduction, medical expenses, or other financial difficulties can make it difficult for homeowners to make their mortgage payments.

-

Subprime lending and predatory practices: During the housing crisis, many homeowners were given mortgages they couldn’t afford or were subject to predatory lending practices, leading to an increased risk of foreclosure.

-

Adjustable-rate mortgages (ARMs): When the interest rates on ARMs increase significantly, homeowners may find it challenging to keep up with the higher mortgage payments, leading to foreclosure.

-

Divorce or death in the family: Major life changes such as divorce or the death of a breadwinner can lead to financial instability and make it challenging to maintain mortgage payments.

Effects of foreclosure

Foreclosure can have significant impacts on homeowners, including:

-

Loss of home: The most obvious effect of foreclosure is the loss of the homeowner’s property. Losing one’s home is not only emotionally devastating but can also disrupt stability and have long-lasting effects on individuals and families.

-

Negative impact on credit: Foreclosure can severely damage a homeowner’s credit score, making it challenging to secure future loans or credit cards. The negative impact can stay on a credit report for up to seven years.

-

Financial consequences: In addition to losing their home, homeowners may still be responsible for any remaining mortgage debt, as well as foreclosure costs and legal fees. This can lead to ongoing financial challenges and further strain on their finances.

This image is property of images.pexels.com.

Foreclosure vs. short sale

While both foreclosure and short sale involve the sale of a property for less than the amount owed on the mortgage, there are significant differences between the two.

Foreclosure occurs when the lender takes possession and sells the property after the borrower has defaulted on their mortgage payments. The lender initiates the process, and the homeowner has limited control over the outcome. The proceeds from the sale go towards paying off the outstanding mortgage balance.

On the other hand, a short sale is a voluntary agreement between the homeowner and the lender to sell the property for less than the outstanding mortgage amount. Homeowners may choose a short sale as an alternative to foreclosure if they are unable to meet their mortgage payments. It requires the lender’s approval and allows the homeowner to avoid the negative consequences of foreclosure.

Foreclosure prevention

If you find yourself facing the possibility of foreclosure, there are steps you can take to try to prevent it from happening. Some potential options include:

-

Contact your lender: As soon as you realize you’re facing financial difficulties that may affect your ability to make mortgage payments, contact your lender. They may be willing to work out a solution, such as loan modification, forbearance, or a repayment plan.

-

Seek professional help: Consider consulting with a foreclosure prevention counselor or a housing counselor approved by the U.S. Department of Housing and Urban Development (HUD). These professionals can provide guidance and help you explore available options.

-

Refinance or loan modification: If your financial situation allows, you may be able to refinance your mortgage or negotiate a loan modification to make your payments more affordable.

-

Government assistance programs: Depending on your circumstances, you may be eligible for government programs such as the Home Affordable Modification Program (HAMP) or the Home Affordable Refinance Program (HARP).

Foreclosure statistics

Foreclosure statistics can provide insight into the state of the housing market and the impact of economic factors on homeowners. Here are a few key statistics:

-

In 2019, there were a total of 493,066 properties with foreclosure filings in the United States, a decrease of 21% from the previous year.

-

As of February 2021, the states with the highest foreclosure rates were Delaware, New Jersey, and Illinois.

-

The COVID-19 pandemic resulted in a temporary moratorium on foreclosure proceedings to protect homeowners affected by the economic crisis. However, it is crucial to stay informed about any updates regarding foreclosure protections and relief programs.

Foreclosure alternatives

While foreclosure can be a distressing experience, there are alternatives that homeowners can explore to avoid losing their homes:

-

Loan forbearance: This temporary solution allows homeowners to suspend or reduce their mortgage payments for a specified period while they work through their financial difficulties.

-

Loan modification: With a loan modification, the terms of the mortgage are adjusted to make the payments more manageable for the homeowner.

-

Refinancing: Homeowners who have equity in their homes may be able to refinance their mortgage to obtain better terms and lower interest rates.

-

Selling the property: If homeowners are unable to afford their mortgage payments, they may consider selling the property before foreclosure becomes inevitable. This can allow them to avoid the credit and emotional consequences associated with foreclosure.

In conclusion, foreclosure is a serious and often distressing process that occurs when a homeowner fails to make mortgage payments. It is crucial for homeowners facing the possibility of foreclosure to seek help and explore all available options to prevent it from happening. Taking proactive steps and seeking assistance can help mitigate the negative impacts of foreclosure and potentially find a resolution that allows homeowners to keep their homes or minimize the financial consequences.